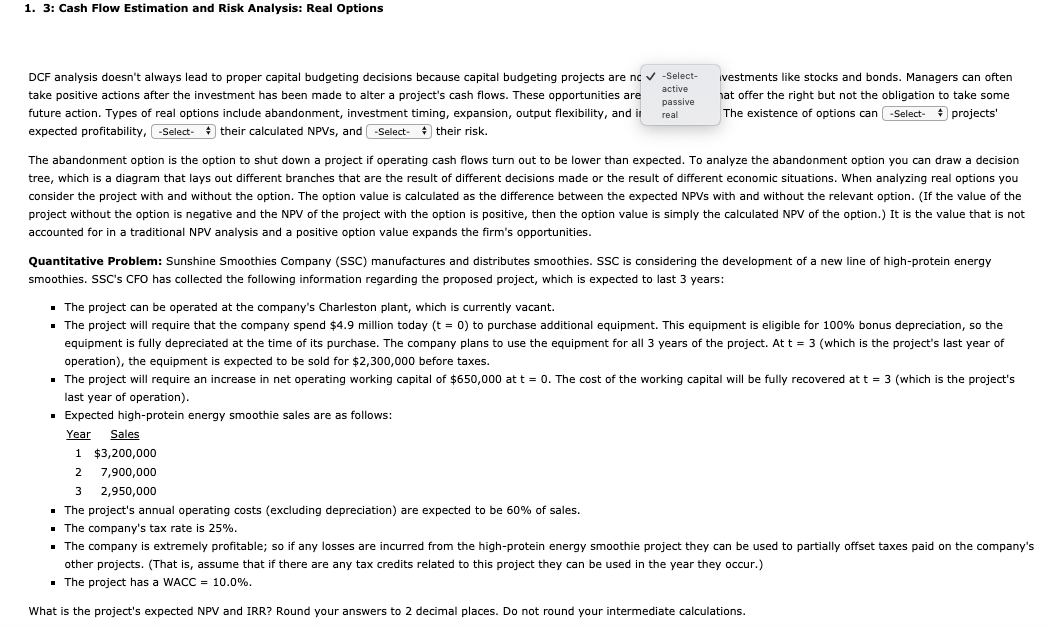

Since present value dictates that money earned today is worth more than money earned tomorrow, the cash flows are discounted. The net present value is the figure that emerges from the DCF analysis (NPV). With the exception of the initial outflow, these cash flows are discounted back to the present. The initial cash outflow required to fund a project, the mix of future cash inflows in the form of revenue, and other future outflows in the form of maintenance and other costs are all examined using discounted cash flow (DFC) analysis.

It is preferable to invest in capital that uses less money in the future while increasing the quantity of money that comes into the company later. Despite this, there are advantages and disadvantages to these frequently utilized valuation techniques.Ĭapital budgeting is intended to help determine how investments in capital assets will impact cash flow in the future.

In accordance with the needs of the business and the management’s selection criteria, some ways will be favored over others. Despite the fact that we will learn about all capital budgeting techniques, the following techniques are the most widely used:Īlthough it may appear that the best capital budgeting strategy would be one that produced favorable results for all three measures, this is not always the case. When making judgments about its capital budget, a corporation must first decide if the project will be lucrative or not.

This is challenging to do in the event that a corporation lacks fixed assets or insufficient funding. The management plans expenditures on fixed assets using the capital budget.

0 kommentar(er)

0 kommentar(er)